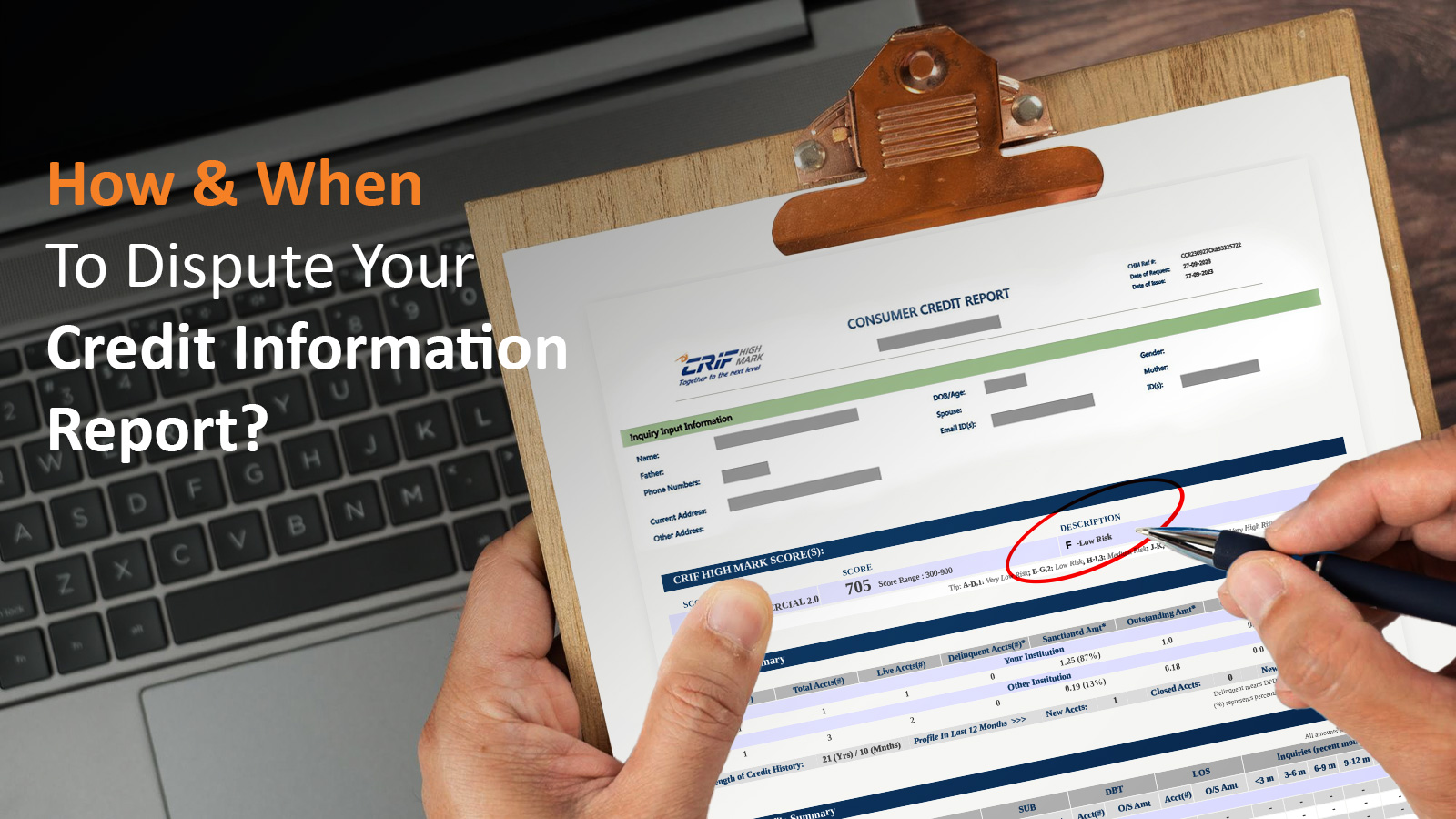

How & When to Dispute Your Credit Information Report?

An error on your credit report could lead to lower credit scores and impact your chances to open a new credit account or get a loan. Errors can occur surprisingly easily on your credit history. It may be that your handwriting was hard to read on a loan application, that a lender mixed up account information, or that you were a victim of identity theft. With so many ways an error can occur, it is indispensable to check your free credit score for accuracy periodically not just when you need a loan.

However, due to a lack of understanding of credit, it can be difficult to determine what factors may affect your credit score and the steps you need to undertake to dispute your credit report. This is also one of the reasons to educate yourself with the concepts of credit score and credit history. Once you’re familiar with your score, if you do find an error in your credit report there is thankfully a way to dispute the inaccuracy.

The fastest way to start a credit report dispute and check your status is by applying online. Disputes are 100% free and require no fee. However, credit reporting agencies are used to receiving many disputes on a daily basis, mostly from people who are just trying to get something legit removed from their reports. Hence, you must be sure about your point and support your dispute with documents.

Following these steps, you may be able to win your credit dispute and get your credit history back on the right track:

Step 1: Download your credit report

First off, you need to download the detailed credit information report from any of the credit bureaus in India such as CRIF High Mark. You are entitled to download one free credit report each year.

Step 2: Inform the credit bureau

Once you are sure about the discrepancy in your report, you have to make it known to the 4 credit bureaus on their respective websites and postal addresses. This information has to be shared in the form of online appeal and in writing via a letter. The letter should clearly contain each item in your report that you dispute. You need to state the facts and explain why you dispute the information and wants it removed or rectified. The letter should be supported with copies of documents verifying your dispute. Always request read receipt for your letters.

Step 3: Contact the Lenders

To ensure the errors are resolved at the source, it may also be a good idea to contact the lenders who supplied the incorrect information to the bureaus. Lenders, also known as furnishers, are the companies that provide the information to the credit bureaus. They include banks and credit card issuers. You can go to the furnisher and ask them to correct the mistake in case it is apparent that the mistake is rectifiable at their end. But if the error is an identity-related mistake made by a credit bureau, it may not necessary to contact your lenders, you can to the bureau directly.

Step 4: Count 30 days

The credit information companies are required to investigate your claim of dispute which generally lasts at least 30 days. During this time, the item on your credit report which is under dispute will be temporarily removed from your credit report. After they have finished their investigation, the bureau is also required to provide you with a free copy of your credit report if it has now changed. While the process can be time-consuming, it is important to continue to dispute incorrect information on your report that negatively impacts your credit score. You can also ask the credit bureau to include information summarizing the dispute on your credit report so future lenders can see your claims and assess them for themselves.

Step 5: Check your credit report:

Updates to your affected credit reports may take some time to appear. It is dependent on the specific credit bureau’s update cycle and when the lender sends the new information to the credit bureau. If the update doesn’t appear on your credit reports within several months, contact the credit bureaus and the lender to verify it’s reporting your account information to the bureaus.